Understanding How Auto Loan Interest Rates Affect Your Car Purchase

When buying a car, understanding how auto loan interest rates affect your purchase is crucial. The interest rate on your auto loan can significantly influence your vehicle’s overall cost, monthly payments, and financial strategy. In this article, we will explore the current auto loan interest rates and provide you with the information you need to make an informed decision when buying your car.

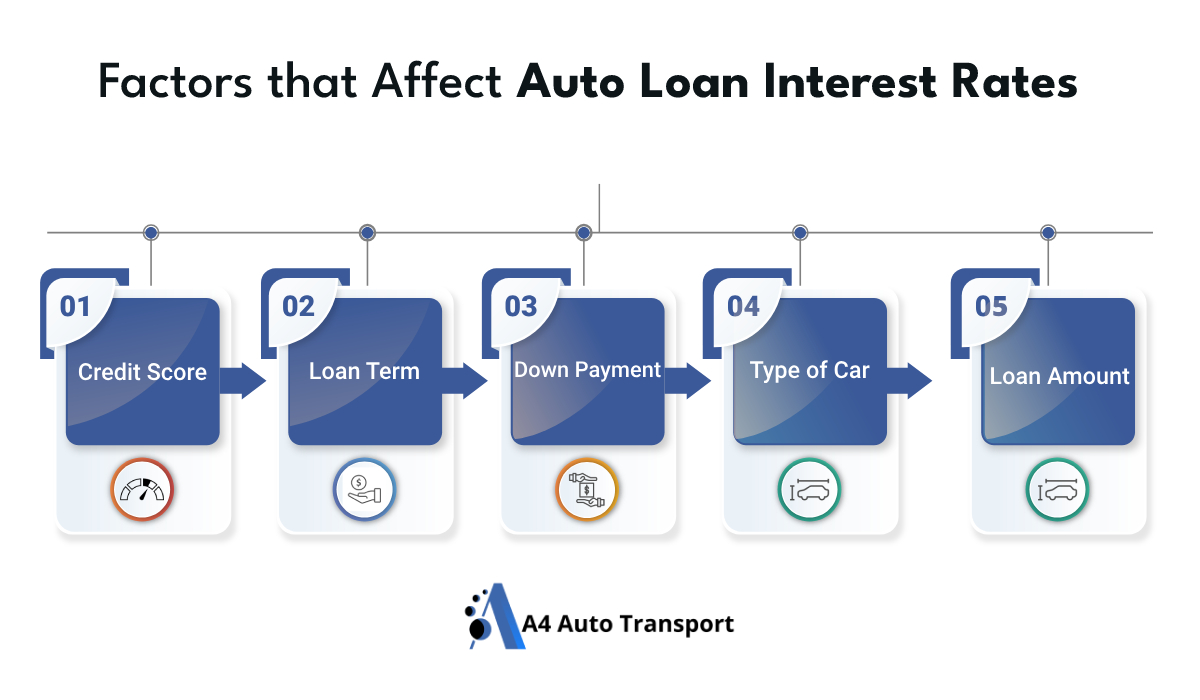

Factors that Affect Auto Loan Interest Rates

1. Credit Score

Your credit score is one of the most significant factors affecting your auto loan interest rate. Lenders use your credit score to assess your risk as a borrower:

- High Credit Score: Typically qualifies for lower interest rates, as you are perceived as a lower-risk borrower.

- Low Credit Score: Often results in higher interest rates due to the increased risk of default.

2. Loan Term

The length of your loan term can impact your interest rate:

- Shorter Loan Terms: Generally come with lower interest rates, but result in higher monthly payments.

- Longer Loan Terms: Often have higher interest rates, as the lender is exposed to risk for a longer period. Monthly payments are lower but you pay more in interest over time.

3. Down Payment

The size of your down payment can influence the interest rate:

- Larger Down Payment: Reduces the loan amount and may help you secure a lower interest rate because it decreases the lender’s risk.

- Smaller Down Payment: Increases the loan amount and may lead to a higher interest rate.

4. Vehical Types and Age

The type and age of the vehicle being financed can affect your interest rate:

- New Vehicles: Often come with lower interest rates due to their higher value and lower risk.

- Used Vehicles: May have higher interest rates because they are perceived as riskier investments due to potential wear and tear.

- Luxury or Specialty Vehicles: Might attract higher rates due to their higher price and repair costs.

5. Loan Amount

The total amount of the loan can influence the interest rate:

- Higher Loan Amounts: Higher interest rates may be due to increased risk for the lender.

- Lower Loan Amounts: Typically result in lower interest rates.

Current Auto Loan Interest Rates for 2024

| Insurance | Available |

|---|---|

| Door To Door Delivery | Available |

| GPS tracking | Available |

| Open Transport | Available |

| Enclosed Transport: | Available |

| Guaranteed Pickup Dates & Times: | Available |

Average Interest Rates for New and Used Car Loans

New Car Loans

| Credit Score | Interest Rate |

|---|---|

| Excellent Credit | 3.49% – 4.99% |

| Good Credit | 4.99% – 6.49% |

| Fair Credit | 7.49% – 9.99% |

| Poor Credit | 10.49% – 14.99% |

Used Car Loans:

| Credit Score | Interest Rate |

|---|---|

| Excellent Credit | 4.49% – 6.49% |

| Good Credit | 6.49% – 8.99% |

| Fair Credit | 9.49% – 12.99% |

| Poor Credit | 13.49% – 17.99% |

Current Auto Loan Interest Rates for 2024 Table

| Type of Loan | Average Interest Rate |

|---|---|

| New Car Loan | 3.49% – 4.99% |

| Used Car Loan | 4.49% – 6.49 |

Now that you know the current auto loan interest rates for 2024 let’s explore some tips that can help you get the best interest rates:

Tips for Getting the Best Auto Loan Interest Rates

- Check Your Credit Score: Higher credit scores generally qualify for lower interest rates.

- Shop Around: Compare rates from different lenders, including banks, credit unions, and online lenders.

- Consider Your Loan Term: Shorter terms often come with lower interest rates.

- Increase Your Down Payment: A larger down payment can help reduce your loan amount and potentially secure a lower rate.

- Negotiate: Don’t hesitate to negotiate terms with lenders to get the best possible rate.

Pros and Cons of Auto Loans

Pros

- Affordability: Auto loans allow you to purchase a vehicle that you might not be able to afford with cash, making it easier to buy a new or used car.

- Build Credit: Making timely payments on an auto loan can help build and improve your credit score, which can benefit future financial activities.

- Flexibility: Loans offer various terms and conditions, allowing you to choose a repayment plan that fits your budget. You can often select from different loan lengths and payment options.

- Ownership: With an auto loan, you eventually own the car outright once the loan is paid off, unlike leasing, where you return the vehicle at the end of the lease term.

- Low Interest Rates: Depending on your credit score and the current market conditions, auto loans can have relatively low interest rates compared to other types of loans or credit.

Cons

- Interest Costs: Over the life of the loan, you will pay more for the car than its purchase price due to interest. The total cost can be significant, especially with higher interest rates or longer loan terms.

- Monthly Payments: Monthly loan payments can strain your budget, especially if you opt for a long-term loan with lower payments or if your financial situation changes unexpectedly.

- Additional Costs: Auto loans come with additional costs like auto insurance, which varies based on factors like driving history; maintenance, including both regular servicing and repairs; and registration fees.

Steps to Apply for a Car Loan

- Check Your Credit Score: Obtain and review your credit report to understand your financial standing and potential interest rates.

- Determine Your Budget: Calculate how much you can afford for a down payment and monthly payments, including additional costs.

- Research Lenders: Compare loan options from various lenders to find the best rates and terms.

- Get Pre-Approved: Apply for pre-approval to know what you qualify for and strengthen your negotiating position.

- Complete the Loan Application: Fill out the application form with the required documents and information.

- Review and Sign the Loan Agreement: Carefully review the terms before signing the agreement and finalize the loan.

Check Your Credit Score

Before you apply for an auto loan, check your credit score. Knowing your credit score can help you negotiate for better interest rates. If your credit score is low, consider improving it before applying for a loan.

Negotiate Loan Terms

Negotiate the loan terms with your lender. A longer loan term can lower your monthly payments, but it can also increase the total cost of the loan. Shorter loan terms can help you save money on interest, but they come with higher monthly payments.

Make a Down Payment

Making a down payment can help you lower your interest rate and reduce the amount of money you need to borrow. Aim for a down payment of at least 20% of the car’s purchase price.

Consider a Co-Signer

If your credit score is low, consider getting a co-signer. A co-signer with a high credit score can help you get a lower interest rate.

Conclusion

Auto loan interest rates are an essential factor that affects how much you will pay for your car in the long run. Understanding the factors that affect auto loan interest rates can help you make an informed decision when buying a car. The current auto loan interest rates for 2023 can vary depending on the lender and the borrower’s credit score, loan term, down payment, and type of car. Use the tips we provided to get the best interest rates when buying your car.

FAQs

What is the average auto loan interest rate for a new car in 2022-2023?

The average auto loan interest rate for a new car in 2022-2023 is currently around 4.5%-5%.

What is the average auto loan interest rate for a used car in 2022-2023?

The average auto loan interest rate for a used car in 2022-2023 is currently around 6%-8%.

How can I improve my credit score to get a lower interest rate on an auto loan?

You can improve your credit score by paying your bills on time, keeping your credit utilization low, and disputing any errors on your credit report. You can also consider getting a secured credit card or a credit builder loan to help build your credit.

Can I negotiate the interest rate on an auto loan?

Yes, you can negotiate the interest rate on an auto loan. It’s always worth trying to negotiate with your lender to get a lower interest rate, especially if you have a good credit score or can make a large down payment.

Is it better to get a shorter or longer loan term when buying a car?

It depends on your individual financial situation. A longer loan term can lower your monthly payments, but it can also increase the total cost of the loan. Shorter loan terms can help you save money on interest, but they come with higher monthly payments. Consider your budget and financial goals when deciding on the loan term that works best for you.

a4AutoTransport is a group of auto transport researchers and experts that comes in handy for anyone who wants to move their car/vehicle without putting extra miles on the odometer. At a4AutoTransport, We researched over a hundred car shipping companies, interviewed real customers and industry leaders, and collected nearly 500 quotes to find the nation’s best auto transport companies. With our combined 5 years of industry experience and research, we’ll help you find the right car shipper for your budget.